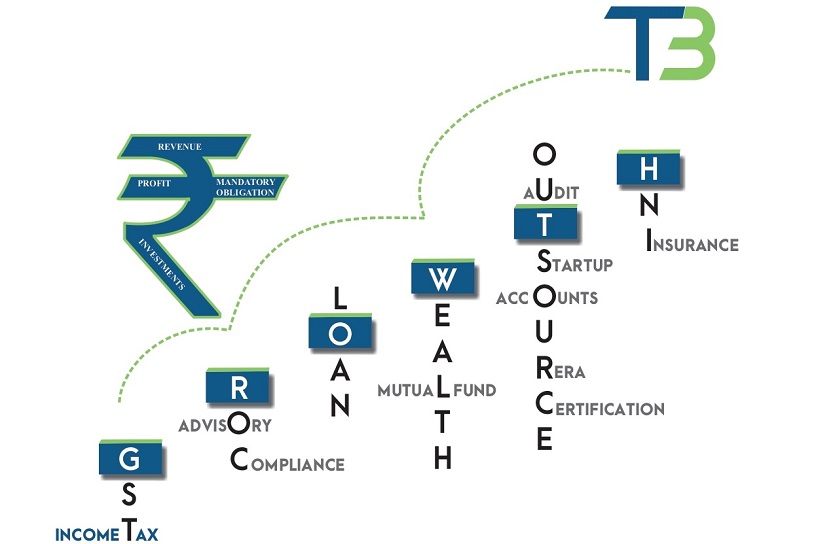

We make Business Easy & Fast

Welcome to TaxBaniya, your premier destination for expert business registration, compliance, and investment advisory services.

At TaxBaniya, we understand the intricate nuances of navigating the complex landscape of business regulations and investment opportunities in Mumbai. Our dedicated team of professionals is committed to providing comprehensive solutions tailored to your specific needs, ensuring seamless compliance and maximizing your investment potential.