A Trusted Name

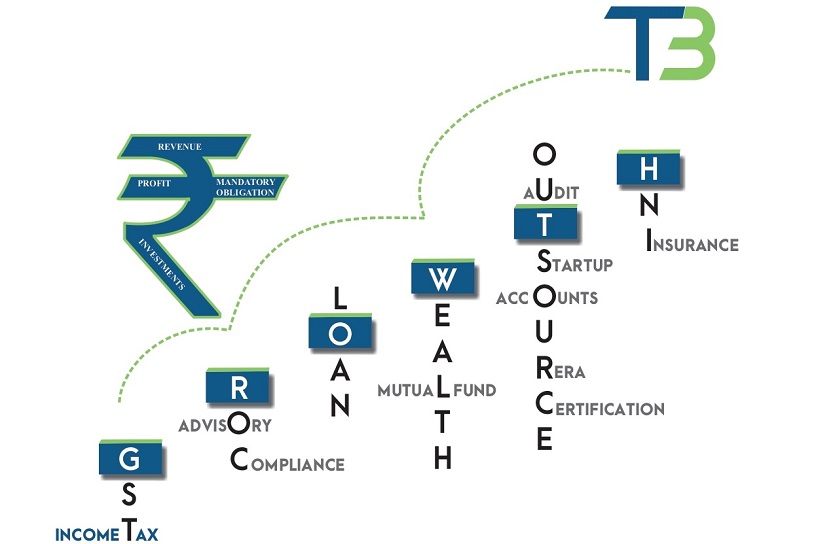

Our Panel of Professionals will assist you with Company Registration, Business Consultancy, Tax Consultancy, Trademark Registration, Annual Filings, Accounting and Business Compliances in India

Company

Registration & Compliance of Private Limited Company, Startup-India

Read MorePartnership LLP

LLP Registration (Online / Offline) , Compliance, Business Outsource

Read MoreFirm

Registration & Compliance of Proprietorship Firms, GST Registration, Professional Tax, etc

Read MoreBest Professional Service

Quick Response

Timely Delivery

On Time Service

100% Assurance

Why Us?

Continuous Support

You can call your Client Manager anytime for all your queries. We provide continuous support all all Pre & Post Registration Compliances, Tax Filings, Trademarks, Book Keeping, etc

Expert Consultation

Our expert consultants will connect with you to understand your business need and we will provide you the best and valid solutions for your business firm.

Confidential & Safe

All your private information is safe with us. No documents store policy. We won't ask for any of your credential documents.

Core Competence

2000+

Happy Customers

15+

Years of Experience

30+

Experts Team

100%

Assurance

Client Testimonial

Why people believe in us is because we do not believe in word of saying we believe in workship We try to give you the best.

Experience CA with dedicated and helpful Team of people

Vikas Singh MULTIPLEXER SOLUTION PRIVATE LIMITEDIt was superb and prompt service provided by them. I am very impressed by their knowledge and overall exexcution of the task assigned. I would recommend them for Income Tax related services to everyone. Thank you...

Kalpana Majumdar Pune - IndiaTeam has done multiple tax compliance successfully in the past for our firm. Looking for reliable agency and want to resolve tax and company process must recommend !!

Pradeep Singh Bodypower GroupRegistration

- Private Limited Company Registration

- Section 8 Company Registration

- LLP Registration

- Proprietorship Registration

- Partnership Registration

- GST Registration

- Trademark Registration

Compliance

- Income Tax Filing

- GST Filing

- ROC Filing

- NRI Taxation

- UDYAM

- FSSAI

Registration Places

- Company Registration in Andheri, Mumbai

- Partnership Firm Registration in Vashi, Navi Mumbai

- GST Registration in Thane, Palghar

- Professional Tax PTRC in Maharashtra